You can’t escape it: Artificial Intelligence.

If you’ve opened a news app, scrolled through LinkedIn, or sat in a corporate meeting in the last 18 months, you can’t escape it: Artificial Intelligence.

Since ChatGPT burst onto the scene, we have been living in an AI gold rush. Companies are pivoting overnight to become "AI-first." Venture capitalists are throwing billions at startups that barely have a business plan, as long as they have ".ai" in their URL. Stock markets have rallied to dizzying heights on the shoulders of chipmakers like Nvidia.

The feeling is electric. It feels like the future is arriving all at once.

But economists and historians are watching this frenzy with a sense of déjà vu. They’ve seen this movie before—with the internet in the late 90s, and housing in the mid-2000s. They know that when enthusiasm decouples from reality, you get a "bubble."

And they know that bubbles always burst.

In this post, we’ll explain what an economic bubble actually is, look at the telltale signs in the current AI landscape, and explore why the AI party might be heading for a painful hangover sooner than many think.

The Anatomy of a Bubble

Before we talk about AI, let’s define what a financial bubble is.

At its core, a bubble happens when the price of an asset—whether it's a tulip bulb in the 1600s, a Pets.com stock in 1999, or a condo in Miami in 2007—rises far above its actual, real-world value.

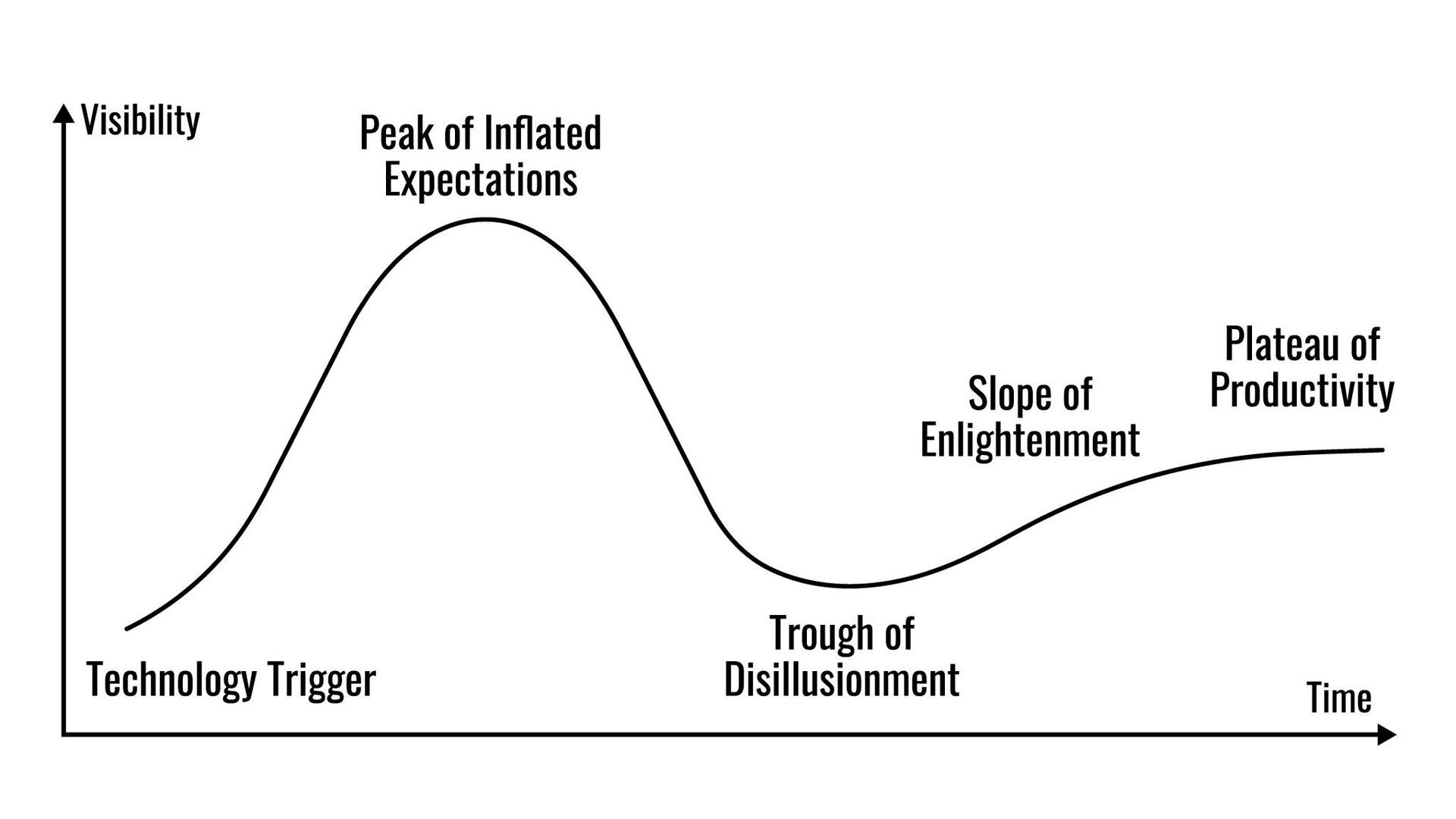

The "Boom" Phase: This is fueled by "irrational exuberance," a term famously coined by former Federal Reserve Chair Alan Greenspan. Investors stop looking at fundamentals (like how much profit a company actually makes) and start buying based on hype, FOMO (Fear Of Missing Out), and the belief that some "greater fool" will come along and buy the asset from them at an even higher price later.

The "Burst": A bubble doesn't usually pop because of one single catastrophic event. It bursts when reality catches up with the hype.

Eventually, investors look around and realize the emperor has no clothes. They realize the startup valued at $1 billion has zero revenue. They realize the technology, while revolutionary, isn't going to change the world by next Tuesday.

When that realization hits, the psychology shifts instantly from greed to fear. Everyone tries to sell at once, prices freefall, and fortunes evaporate overnight.

The AI Hype Cycle: Are We in a Bubble?

It is undeniable that Generative AI is a transformative technology. It will change how we work, code, and create. But "transformative technology" and "financial bubble" are not mutually exclusive concepts. The internet did change the world, but the Dot-com bubble still burst in 2000, wiping out trillions of dollars in wealth.

There are several flashing red lights suggesting AI is currently in bubble territory:

As the Gartner Hype Cycle illustrates, new technologies often go through a period of "inflated expectations" before reality sets in.

1. The

Valuation Disconnect

Startups are raising money at eye-watering valuations based on future promises rather than current metrics. Companies are adding "AI" to their press releases and seeing their stock prices jump, even if they have no clear strategy for how AI will actually improve their bottom line.

2.

Extreme FOMO in the C-Suite

Every CEO is terrified of being left behind. This leads to panic-buying of AI software and massive enterprise investments not because the ROI (Return on Investment) is clear, but because "everyone else is doing it."

The Pin Pricks: Why the Burst Might Happen Soon

If we are in a bubble, what’s going to pop it? The AI burst likely won't happen because the technology fails; it will happen because the economics don't make sense yet.

Here are three reasons why a correction might be imminent:

1. The Infinite Money Pit (The Cost Problem)

AI is incredibly expensive. Training large language models costs tens of millions of dollars. Running them (the "inference" costs whenever you ask ChatGPT a question) is even more expensive in terms of computing power and electricity.

Right now, VC money and big tech war chests are subsidizing these costs. But soon, companies need to show a path to profitability. If it costs $1 to generate 50 cents of value, the business model is broken. The market will soon demand to see real profits, not just cool demos.

2. The "Pilot Purgatory"

Many large corporations are currently running AI pilot programs. They are testing the waters. The hype suggests these will all turn into massive, company-wide deployments.

However, many companies are finding that while AI is great for drafting emails or summarizing documents, integrating it safely into core business workflows is difficult, risky, and expensive. If a significant percentage of these pilots don't convert into massive, long-term contracts, the revenue projections for AI companies will collapse.

3. The Reality Gap (Hallucinations and Reliability)

The marketing promised us Artificial General Intelligence (AGI) that could replace human workers. The reality is a very impressive chatbot that still "hallucinates" (confidently makes things up) and struggles with basic logic puzzles.

For critical business tasks—in finance, healthcare, or legal—95% accuracy isn't good enough. The gap between the promised utopia and the messy reality is widening, and patience is wearing thin.

The Aftermath: A Healthy Correction

When the AI bubble bursts, it will be painful. Many hyped-up startups will go bankrupt. Stock markets will take a hit. Investors will lose money.

But this is not the end of AI.

A bubble burst is usually a necessary "cleansing fire" for an innovative industry. The Dot-com crash killed off the weak companies with bad business models, but the strong survivors—Amazon, Google, eBay—built the foundation of the modern internet.

The same will happen with AI. When the hype dies down, the real work begins. The companies that are solving actual problems with sustainable business models will emerge from the ashes stronger.

We are likely heading for a reality check. The party is fun right now, but it’s time to start preparing for when the music stops.

Cost-Effective Turnkey Solutions at Just $99/month.

Transform your online presence with Rich Keller.

Starting at $99/month, you receive:

- Professional Website

- AI Tools for Writing

- SEO Optimization

- Digital Marketing Services

- Unlimited edits.